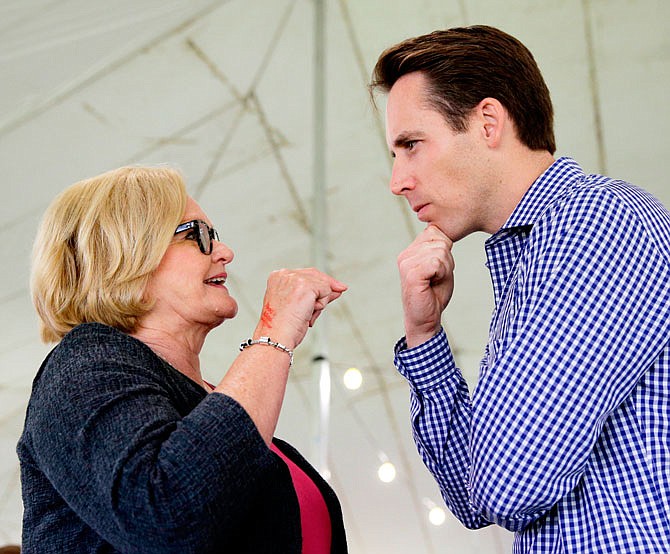

JEFFERSON CITY, Mo. (AP) - Missouri's U.S. Senate candidates Democrat Claire McCaskill and Republican Josh Hawley have released their 2017 tax returns.

The candidates released their taxes Wednesday.

McCaskill filed separately from her husband, wealthy businessman Joseph Shepard. McCaskill's return shows she brought in a roughly $86,000 pension on top of her $174,000 salary. She also claimed about $89,000 in deductions, although she did not release an itemized list with further details.

Hawley and his wife filed a joint return and together brought in an adjusted gross income of about $296,000. They claimed about $39,000 in itemized deductions.

McCaskill is a top target for Republicans seeking to expand the party's slim 51-49 edge in the U.S. Senate. She is among 10 Senate Democrats up for re-election this year in states that President Donald Trump won.