Stocks closed broadly higher on Wall Street Wednesday, sending the S&P 500 to a record high for the second time this week, as investors welcomed the Federal Reserve’s decision to lower interest rates for the third time this year.

The central bank also indicated it won’t cut rates again in the coming months unless the economic outlook worsens. The Fed has been using its power to cut short-term interest rates in a bid to shore up the economy amid the costly impact from the U.S.-China trade war.

With its latest rate cut, the Fed has nearly reversed the four rate hikes that it made in 2018.

Stocks wobbled shortly after the Fed’s midafternoon announcement, which had been widely anticipated by traders. The market then rallied into the close, led by gains in technology and health care stocks. Bond yields fell.

The S&P 500 index rose 9.88 points, or 0.3 percent, to 3,046.77. The benchmark index also hit record high on Monday.

The Dow Jones Industrial Average gained 115.27, or 0.4 percent, to 27,186.69. The Nasdaq composite added 27.12 points, or 0.3 percent, to 8,303.98.

The Russell 2000 index of smaller company stocks fell 4.23 points, or 0.3 percent, to 1,572.85.

Major stock indexes in Europe closed mostly higher.

U.S. stock indexes were mostly flat ahead of the Fed’s announcement Wednesday.

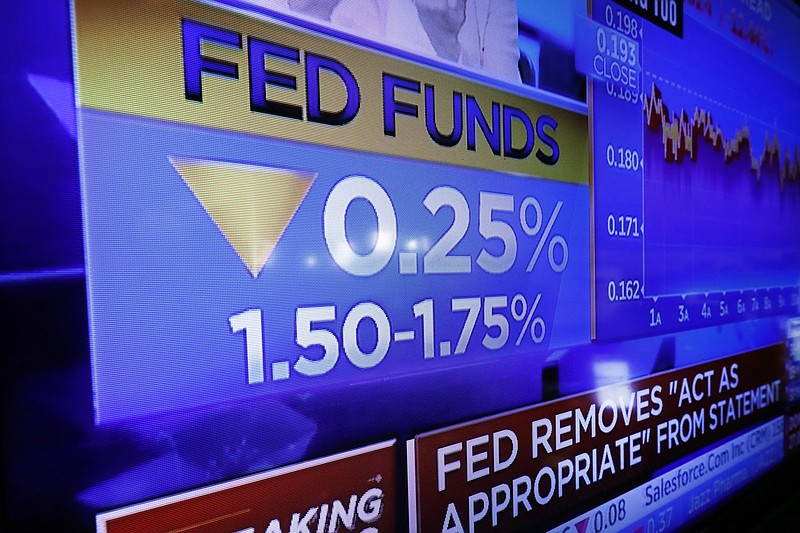

The central bank’s latest move reduces the short-term rate it controls — which influences many consumer and business loan rates — to a range of 1.5-1.75 percent.

Lower rates are intended to encourage more borrowing and spending. Rising global risks have led the Fed to change course after hiking rates four times last year.

The market was expecting another cut this month, which shifted investors’ focus to what the Fed might say about the prospects of further rate reductions.

During a news conference, Federal Reserve Chairman Jerome Powell signaled the central bank will likely forgo additional cuts to its benchmark rates while economic growth and inflation matches the Fed’s outlook.

The central bank’s rate reductions are intended as a kind of insurance against threats to the economy, which is in its 11th year of expansion, fueled by consumer spending and a solid if slightly weakened job market.

On Wednesday, the Commerce Department said the U.S. economy slowed to a modest growth rate of 1.9 percent in the July-September quarter. That surpassed economists’ forecasts for even weaker growth, however.

The report indicated consumer spending downshifted and businesses continued to trim their investments in response to trade war uncertainty and a weakening global economy.

Technology and health care companies drove much of the market’s broad gains Wednesday. Microsoft rose 1.3 percent, while Johnson & Johnson climbed 2.9 percent.

Those sectors helped offset losses in energy and financial stocks.

Energy stocks took the heaviest losses. Chevron slid 1.5 percent and Helmerich & Payne fell 4.3 percent. The sector dropped 2.1 percent, lowering its gains for the year to just 1.1 percent. That’s the smallest gain of all the sectors in the S&P 500.

Several big banks helped pull financial sector stocks lower as bond yields declined. The yield on the 10-year Treasury note dropped to 1.77 percent from 1.83 percent late Tuesday. The yield is a benchmark for interest rates that bank charge for mortgages and other loans. JPMorgan dropped 0.6 percent and Bank of America slid 1.4 percent.

Investors continued to focus on a steady flow of corporate earnings.

Apple, Facebook and Lyft climbed in after-hours trading after reporting quarterly results that topped Wall Street’s forecasts. Twitter slumped after the social media company announced it is banning political ads from its service. CEO Jack Dorsey said advertising on social media offers an unfair level of targeting compared to other mediums that brings significant risks to politics.

Mattel surged 13.8 percent after the toy maker breezed past Wall Street’s third-quarter profit forecasts on strong sales of its Barbie and Hot Wheels brands. The company also put investors at ease when it said that it hasn’t seen any impact from tariff increases on toys imported from China ahead of the Dec. 15 deadline.

General Electric jumped 11.5 percent after the industrial conglomerate raised its projections for a key measure of profitability despite a damaging trade fight and ongoing problems with Boeing’s 737 Max, which GE helps make engines for.

Molson Coors Brewing, which trades under the symbol “TAP,” fell 3.1 percent after announcing a restructuring plan as it faces declining beer sales. The company is laying off 500 workers worldwide as it streamlines operations in a bid to bring new products to market more quickly, like the canned wine and hard coffee it introduced this year.