Jefferson City is woefully short on affordable housing.

While not-so-surprising, the findings of the Jefferson City Housing Needs Assessment set some wheels in motion. It is a piece of the puzzle developers needed to seek low-income housing tax credits, according to Rachel Senzee, Jefferson City neighborhood services supervisor.

Three developers will use the document in part to justify needs as they approach the City Council on Tuesday evening. The developers are seeking recently announced federal disaster funding (from the 2019 tornado) and state-managed low-income housing tax credits.

The study has a lot to say about the status of housing in Jefferson City, said Susan Cook-Williams, executive director of River City Habitat for Humanity and a member of the Capital City Housing Task Force.

"It does tell a lot of what the people in the field already knew," Cook-Williams said. "There is a severe shortage of affordable housing."

The Jefferson City housing study, released at the end of August, identified nine key findings and opportunities.

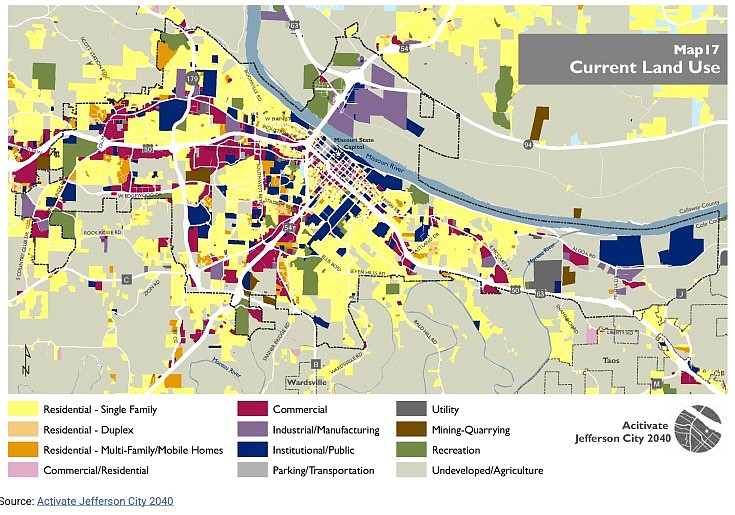

It highlighted the city's "stable" population. While population is not growing, neither is it declining. The population has increased by 0.34 percent during the past decade. Meanwhile, the demographics of the city are evolving, and the percentage of residents in the city who live in single-family households is increasing.

Second, Jefferson City's population is aging. Again, while the population is essentially stationary, its "age composition" has shifted during the past decade. Residents whose ages are 65 and older have increased 12 percent since 2011 -- following a a trend in the seven-county region surrounding the city. For comparisons, the study in some cases includes data concerning Cole, Boone, Callaway, Maries, Miller, Moniteau and Osage counties. Near the other end of age spectrum, the city also had an increase in residents ages 18-24 during the decade. The report theorizes that younger workers are staying in the city or that older children remain living with family members.

"It really states in here -- a lot that what we need is the rentals," Cook-Williams said. "And, we need to support and keep people in their homes, because we have an aging housing market."

The third finding again points to a change in the city's population at the ends of the spectrum. The study found household ownership is increasing among residents younger than 24 and older than 65.

"Renter households tend to be spread more evenly with increases in householders (younger than) 34 and (older than ) 65," it stated. "It seems while householders ages 35-64 are growing elsewhere in the region they are comprising a smaller share of households in Jefferson City."

A fourth finding was that central Jefferson City neighborhoods are some of the most ethnically and racially diverse in the city, but also some of the poorest. Home values and incomes in the neighborhoods are lowest, and residential structures are the oldest. These communities have some of the highest volumes of rental housing. The central part of the city is also an area where the May 22, 2019, tornado did most of its damage, resulting in demolition of a high percentage of housing.

Citywide, the fifth finding states, median household incomes and levels of educational attainment are rising.

"With more household income comes the ability to pay more for housing, both ownership and rental units," the report findings stated. "This in turn can result in sale prices and rent rates rising, leaving behind our most vulnerable residents."

Lower-income households tend to be renters, according to the sixth finding.

As of 2020, about 46 percent of renting households in the city had incomes of $30,700 or less -- 50 percent of the median household income in the region. Those households can afford rents of about $768 per month, according to the report. But, rents continue to rise citywide, putting those households at risk for housing instability.

Another challenge in Jefferson City, according to the seventh housing study findings, is single-family homes' dominance of housing stock.

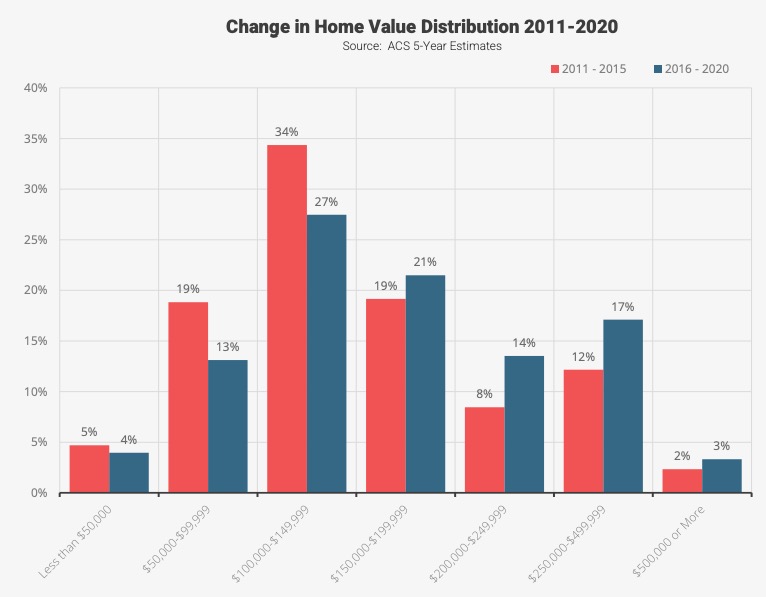

Single-family homes make up the largest part of housing stock in the city. On top of that, single-family homes are the most common structures for new construction. Their prices -- particularly in 2020-21 -- have dramatically risen, likely pushing them beyond the reach of many Jefferson City households.

The eighth finding is that rent is also rising.

Median rent rates have risen about 12 percent since 2011, pushing up the number of rental units priced at more than $500. The volume of those units increased by 987 units (21 percent) since 2011, according to the report.

"Renter households in Jefferson City experience higher levels of cost burdening compared to owners, which may continue to worsen as rents increase faster than incomes," the report states.

Cost burden (or rent burden) occurs when renters spend more than 30 percent of income on housing and "severe rent burden" occurs when they spend more than 50 percent of household income on housing.

And the final finding was that housing "gaps" occur for low-income and high-income households in Jefferson City. Slow rates of new construction over the past 20 years have created pressure on middle-income markets. What happens is low-income households have to move up and buy or rent more expensive units than they can afford, while higher-income households end up in less expensive units than they technically can afford, according to the report.

"(The assessment) talks a lot about the housing compression," Cook-Williams said. "(Upper-income families are) buying the houses the middle income need. So there are no houses for them. They're buying houses the low-income want.

"(The assessment) had a lot of good suggestions in there, as far as solutions."

The assessment recommends tackling housing issues along a set of strategies that could align efforts across local organizations and funding sources.

Supply strategies seek to encourage production of housing units. Those strategies include conducting zoning reviews, encouraging development of "middle housing," establishing a workforce housing fund, establishing an "affordable housing trust fund," and offering a rental production loan program.

The city should review existing zoning and reduce barriers to housing production, such as zoning districts that allow for certain residential types by special permit rather than "by-right," the assessment offers. The city should assess where there might be areas to expand opportunities for housing by reviewing barriers, such as use restrictions, dimensional requirements, open space requirements, height restrictions, lot area and lot area per dwelling unit requirements and parking. It should identify areas for multi-family zoning and pre-zone them for eventual development. It should consider more multi-family use within commercial zoning districts.

"To address the need for more diverse housing types and price points in some of Jefferson City's neighborhoods, particularly the strategically monitored neighborhoods, the city should review its zoning districts and explore adding new use definitions and design guidelines for three- to four-unit buildings or three- to 10-unit buildings," the assessment states. "The city may want to consider using a density 'bonus' as an incentive to encourage home ownership."

In such a case, the city could tie the allowance of a higher density building to a restriction on the units that they be owner-occupied and not rented for short- or long-term use.

Deed restrictions could be attached to the unit which makes prospective buyers or future owners aware of the restriction on the unit.

Jefferson City may also want to consider creating design guidelines or pre-approved designs so new structures more closely resemble the form and function of the neighborhood, the assessment suggests.

Rehabilitation and preservation strategies would seek to build capacity within existing programs to improve the quality of the city's housing stock and neighborhoods, according to the report. Some opportunities along this line might be to expand funding capacity for rehabilitation and preservation programs, establish a land bank or establish a community land trust.

Home ownership strategies would seek to help households seeking home ownership or who are struggling to remain in their current homes. The assessment calls for expansion of the first-time homebuyer program, creation of a housing counseling program and better marketing for housing in Jefferson City.

A housing assistance strategy would focus on homelessness, challenges facing older adults and people with disabilities, and quality of housing. The report calls for a landlord partnership program, support for older adult housing assistance and establishment of an eviction prevention program.

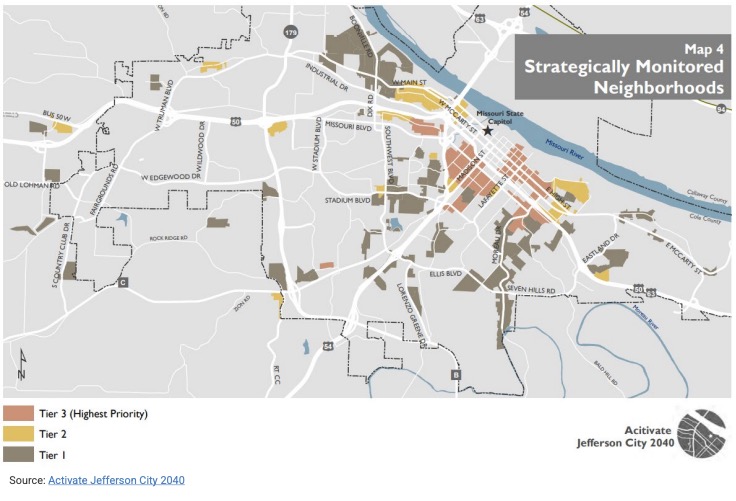

The assessment calls for using strategically monitored neighborhoods to target community development in parts of Jefferson City that have aged and deteriorated. These neighborhoods should be prioritized for the implementation of strategies and funding opportunities identified in the Jefferson City 2040 comprehensive plan. Based on the methodology outlined in the comprehensive plan, strategically monitored neighborhoods look at three criteria -- average age of structure built prior to 1960, average value of structure below $70,000 and those neighborhoods whose owners occupy less than 50 percent. They would fit within three tiers: Tier 1 meets one criteria. Tier 2 meets two criteria. Tier 3 meets all criteria.

Tier 3 would be identified as a high priority.

"Data analysis conducted for this study couple with the analysis from the comprehensive plan indicated that many of the strategically monitored neighborhoods identified in the comprehensive plan remain high priority status," the assessment found.

The assessment, Cook-Williams pointed out, demonstrated a number of single people or couples without children are buying homes in the city. She said that may indicate there is a market for smaller homes, such as single-bedroom homes.

"Habitat has in general built three- or four-bedroom homes," she said. "It sounds like now there is potentially a market for that single-person home."

She also noted the ages of homebuyers/renters is changing, and the Jefferson City population is aging.

"We talk about the aging households and the aging homes in the city," Cook-Williams said. "That middle group that we're losing -- maybe they're coming back to retire here."

CORRECTION: This article was edited at 8:44 a.m. Sept. 6, 2022, to correct a typographical error which affected the meaning of a sentence. The corrected sentence now reads, "A fourth finding was that central Jefferson City neighborhoods are some of the most ethnically and racially diverse in the city, but also some of the poorest."

A city assessment says strategically monitored neighborhoods should be prioritized for the implementation of strategies and funding opportunities identified in the Jefferson City 2040 comprehensive plan. Strategically monitored neighborhoods look at three criteria — average age of structure built prior to 1960, average value of structure below $70,000 and those neighborhoods whose owners occupy less than 50 percent. They would fit within three tiers: Tier 1 meets one criteria. Tier 2 meets two criteria. Tier 3 meets all criteria.

A city assessment says strategically monitored neighborhoods should be prioritized for the implementation of strategies and funding opportunities identified in the Jefferson City 2040 comprehensive plan. Strategically monitored neighborhoods look at three criteria — average age of structure built prior to 1960, average value of structure below $70,000 and those neighborhoods whose owners occupy less than 50 percent. They would fit within three tiers: Tier 1 meets one criteria. Tier 2 meets two criteria. Tier 3 meets all criteria.