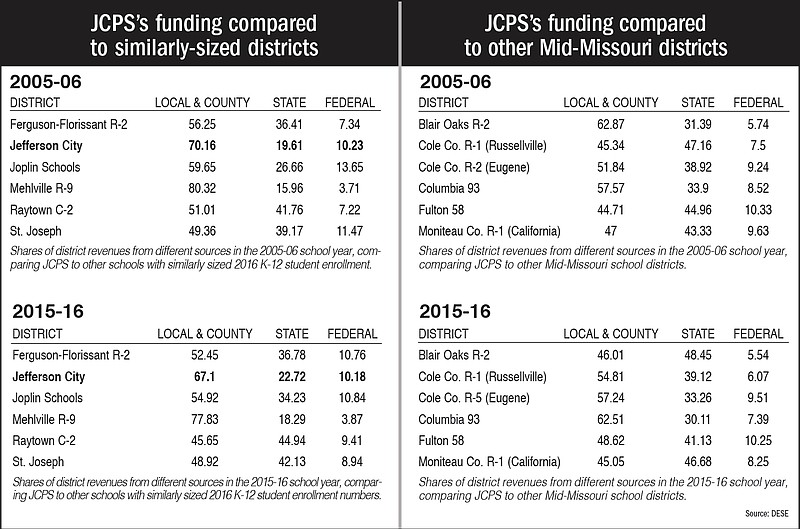

Jefferson City Public Schools receives less of a share of its revenue from the state than other districts its size, according to data from the state's Department of Elementary and Secondary Education.

DESE released its "School District Revenue Percentages" report last week at the department's monthly board meeting.

The report shows, compared to a decade ago, more school districts in the state receive a greater share of their revenue from local and county sources - like tax levies - than from the state or federal government.

That increased dependence on local funding to support public education is also greater than almost all other states'.

Jason Hoffman, JCPS' chief financial and operating officer, said the numbers in DESE's report for his district are part of "a long history of getting a low amount" of aid from the state.

"Under the prior formula, Jeff City got hardly any state aid per pupil," Hoffman said, referring to a previous version of the state's foundation formula that exists to combat inequity in districts' funding.

The formula was revised in 2006-07, and it has changed in JCPS' favor: Compared to the 2005-06 school year, the district received a slightly greater share of its revenue from state aid 10 years later, and less from local sources.

JCPS was still getting about half the share of state funding for its revenue compared to some other districts of similar student enrollment, like Raytown or St. Joseph, in 2015-16, though.

Hoffman said the tax levy increases voters approved in the April municipal election to pay for the district's two high school projects mean the share of JCPS' funding that comes from local sources will go up again, as "the state share is not going up dramatically."

He added it's difficult to say if Jefferson City is at a disadvantage compared to other districts that receive higher shares of state aid because budgets can vary a lot from one district to another, even if they are of similar-sized student bodies.

If JCPS' share of state funding in its revenues was higher, he said, "it would probably just enable us to operate with a lower fund balance."

With a greater dependence on local funding, JCPS receives much of its funding at the beginning of the year after property taxes are collected in December.

State aid is disbursed more evenly on a month-to-month basis, meaning if the district had a greater share of state aid in its budget, it wouldn't need to stretch its money for as long to get to the end of the year. Hoffman added, more money in the budget could be spent throughout the year instead of being kept on hand in reserve.

It's also not easy to determine if the district's greater reliance on local funding puts local taxpayers at a disadvantage of being more responsible for supporting their local education system.

Local tax rates ultimately determine the level of equity between residents' tax responsibilities in different municipalities, Hoffman explained. For example, even with the passage of the increased tax levies in April, Jefferson City taxpayers still will pay a lower assessment rate than residents of Raytown.

The full revenue percentages report is available at dese.mo.gov/sites/default/files/SchRevPer10-17.pdf.