Farmer Holding Company's plans to redevelop the historic St. Mary's Hospital site into a retail, office and shopping center gained momentum this month after two reports by Jefferson City staff recommended the project's approval.

FHC officials said the company started lining up potential restaurant and office tenants at the site two years ago and has several interested tenants.

A May 11 city report found the rate of return on investment would be too small to spur private redevelopment of the site without taxpayer assistance. A separate staff report to the Tax Increment Financing Commission the same day recommended approval of FHC's plans to use taxpayer funding to partially offset the cost of redeveloping the site.

Both reports were crucial for FHC as it attempts to secure between $6.7 million and $7.3 million in public funding for two potential projects. The TIF Commission was supposed to vote May 18 on whether to recommend approval of TIF funds for the project to the full City Council, but the vote was pushed back to June 14 because both reports were turned in before Jefferson City Public Schools officials could review the reports.

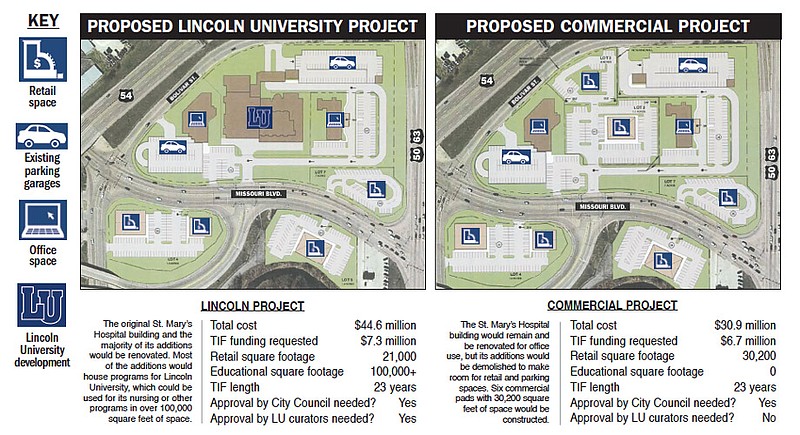

FHC presented two projects to the TIF Commission. One would create space for Lincoln University, and the second would redevelop the site for only commercial use.

Under the Lincoln project, the original St. Mary's Hospital building and the majority of its additions would remain standing and be renovated. Most of the additions would house programs for Lincoln University, which could be used for its nursing or other programs in more than 100,000 square feet of space. Four commercial pads with 21,000 square feet of space would be constructed.

Under the commercial plan, the St. Mary's Hospital building would remain and be renovated for office use, but its additions would be demolished to make room for retail and parking spaces. Six commercial pads with 30,200 square feet of space would be constructed.

In both plans, a parking garage nearest the hospital would be demolished, but two other parking garages would remain standing. A medical office building and the original hospital building, constructed in 1905, would be renovated for office use.

FHC estimates the Lincoln project will cost $44.6 million and asked for $7.3 million in TIF funding for the project. The company estimates cost of the commercial project at $30.9 million and asked for $6.7 million in TIF funding.

FHC Principal Rob Kingsbury said the company has several restaurants ranging from sit-down to fast-food and fast-casual establishments interested in leasing space. Several office tenants are also interested in leasing space at the site. If built, construction should start in 2018, and the company expects the project to be finished in 2020.

Before awarding TIF funding, municipalities must perform a "but-for test." This financial analysis determines if projects would likely happen without public assistance. Jefferson City's financial adviser, Springsted, found the St. Mary's Hospital redevelopment likely would not happen without public assistance.

"For both projects, the projected (rate of return) without assistance to the developer falls below the current range expected within the marketplace," according to the report. "Both development scenarios would have to realize either cost savings, revenue increases or a combination of the two for the project to be undertaken without public assistance."

In its proposal, FHC said the rate of return on investment for both projects without TIF funding would be minus 6.32 percent. With TIF funding, the return on its investment would be 8.65 percent on the Lincoln project and 8.79 percent on the commercial project.

At the recent TIF Commission meeting, FHC attorney Korb Maxwell, with Kansas City law firm Polsinelli, said this project has numerous unique challenges. While the hospital is not a landmark, developers want to preserve the hospital building. The piecemeal framework of hospital additions also makes the project tough.

This month, FHC began soliciting bids to remove asbestos from all the buildings on the site, and it's believed some are covered in asbestos, which complicates environmental concerns. Maxwell said 8.65 percent is a reasonable return on investment.

"It is an unbelievably challenging project," Maxwell said. "There are very few developers that would accept an 8.65 percent return to do a project this difficult in this type of area."

To qualify for TIF funding, projects must be in a blighted area or in an economic development area that has not been subject to growth through private investment and would not be expected to do so. The staff report and but-for report said the St. Mary's proposal meets requirements to fall under a blighted area.

"The redevelopment area is a blighted area and has not been subject to growth and development through investment by private enterprise and would not reasonably be anticipated to be developed without the adoption of tax increment financing," according to the but-for report.

The May 11 city staff report said the project meets the six conditions required for TIF funding.

FHC would pay for all costs initially through private equity and financing. If approved by the City Council, TIF financing will be paid out over 23 years. Kingsbury said this protects taxpayers if the project fails.

"TIF is a tool that allows us to take all of the risk in redeveloping the site," Kingsbury said. "If we are unsuccessful, the taxpayers are out no money. If we are successful in creating economic activity on the site, we are able to get reimbursed a portion of our costs."

FHC proposed taxpayers pay for their share primarily through two sales taxes, including a 1 percent sales tax that's expected to last 40 years. These will generate a combined $6.65 million for the Lincoln project or $6.02 million for the commercial project.

The company also proposed to capture .75 percent of the 1 percent of the city's economic activity taxes that are not captured by the TIF. This would create an additional $700,651 for the Lincoln project or $671,735 for the commercial project.

Kingsbury said FHC would cover all additional costs and would not ask the city for more money after the TIF's approval.

Over the maximum 23-year life of the TIF, FHC projects $8.67 million from the Lincoln project and $11.29 million from the commercial project being returned to state, county, city and other taxing jurisdictions, according to the proposal.

Before FHC bought the property, St. Mary's Hospital usually paid nothing in property taxes. Kingsbury said FHC currently pays $23,051 per year in property taxes on the 9.8-acre property.

From 2017-39, FHC would continue to pay $23,051 per year in property tax. From 2017-39, FHC would pay no property tax, Kingsbury said. But, when the TIF expires, FHC's property taxes will increase to $743,202 per year under the Lincoln project and $1.3 million per year under the commercial project.

He also said FHC projects about $904,000 in annual sales tax collections on the property for the city after the TIF expires.

"We see this as a property on the front door of our community," Kingsbury said. "We want to redevelop it into a multi-use property that people are proud of that live here."