The Jefferson City Council is nearing the end of its annual budget process and has had to make cuts to various city departments to deal with declining revenues.

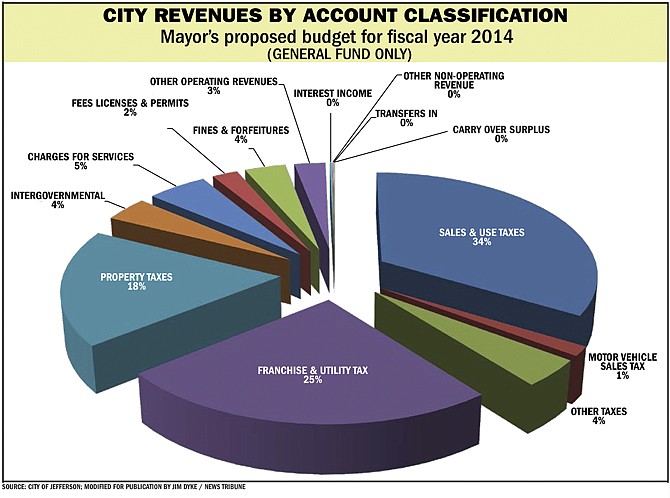

The city relies on three major sources of funding for general revenue, with 2014 projections calling for 34 percent of general revenue to come from sales tax, 25 percent from franchise and utility taxes, and 18 percent from property taxes. The remaining sources of revenues, accounting for 23 percent, come from fines and forfeitures; fees, licenses and permits; charges for services; motor vehicle and other sales taxes; intergovernmental funds; and other operating revenues.

Richard Sheets, deputy director of the Missouri Municipal League, said most municipalities are funded in the same way.

"Cities are pretty limited in their revenue. They're limited to a property tax, and then the primary revenue source mostly is the sales tax," Sheets said. "That's really what cities generate."

A look at some Missouri cities comparable in size to Jefferson City confirms Sheets' statements.

In its 2014 budget, University CIty, with a population of 35,362, estimates it will receive 28.1 percent of its budget from sales taxes and 16.5 percent from property taxes. Another 20 percent of University City's budget is estimated to come from its gross receipts, or utility taxes.

Other cities rely less heavily on property taxes, often shifting the revenue burden to sales taxes.

Cape Girardeau, with a population of 38,402, estimates it will receive 41.4 percent of its current general fund budget from sales taxes and 7.1 percent from property taxes. Another 20.1 percent is estimated to come from franchise taxes.

Chesterfield, with a population of 47,471, has an extremely low property tax rate and none of the revenues from those taxes go to the general fund. Chesterfield's property tax revenues go toward debt service on a previous parks bond issue and cannot be used by the general fund. Sales taxes make up 51 percent of the city's current budget, with another 21 percent coming from utility taxes.

Joplin, with a population of 50,559, also has a low property tax rate that is not used for the general fund. Joplin's sales tax revenues account for 77.5 percent of the city's current budget.

Sheets said across the board cities rely on property and sales taxes, with franchise or utility fees almost always coming in third.

"There's not much flexibility in revenues for municipalities," Sheets said.

"Those are the three major sources for municipalities across the state."

Columbia, with a population of 110,438, largely follows the same formula, with 27.02 percent comes from sales taxes and 9.04 percent coming from property taxes.

The other major source of funds for Columbia's general fund is intragovernmental revenues, which are charges to city funds outside of the general fund for the services provided by the administrative departments. Intragovernmental revenues make up 23.12 percent of the city's general revenue.

Most municipalities' intragovernental funds make up a small portion of their budgets, but Columbia has large enterprise funds because of the amount of fees and service charges the city brings in.

According to Columbia's 2014 budget, fees and service charges include utilities, transit and recreation, as well as charges for parking. However, the funds from fees and service charges are not put into the city's general fund, but into enterprise funds.

"Columbia has an electric utility," Sheets said. "It does generate some income for the municipality ... but there's only probably 40 cities with an electric utility in the state."