Missouri Gov. Mike Parson on Wednesday signed an income tax cut and a package of incentives targeting rural economic projects into law, putting the finishing touches on a special legislative session he convened last month.

Both proposals were the result of vetoes issues earlier this year by Parson, who objected to a tax rebate plan created by lawmakers and an incentives package he felt expired too quickly.

"Missouri's elected officials have been hard at work at the State Capitol to pass critical support for farmers and ranchers and the largest income tax cut in state history for all taxpaying Missourians," Parson said in a statement. He later added: "Today, on the successful conclusion of our special session, we are proud to sign two historical pieces of legislation into law."

When Parson called for the special session in August, he asked lawmakers to cut the top income tax rate to 4.8 percent from the current 5.3 percent.

The bill heading to his desk cuts the top rate to 4.95 percent immediately and would, if revenue growth meets targets, lower the rate to 4.5 percent in four additional steps.

The new special session call indicates the bill would, when fully implemented, reduce general revenue by $764 million a year. The general revenue fund had $12.9 billion in revenue in the fiscal year that ended June 30. The year ended with a surplus of almost $5 billion.

Democrats and their allies argued the bill will ultimately be much more expensive, with the liberal Missouri Budget Project predicting the cost at more than $1 billion per year.

At a time when the state faces a vast array of unmet needs -- including a crisis in staffing in Missouri's child welfare agency -- the tax cut plan will further drain resources at the expense of the state's most needy, said Amy Blouin, president and CEO of Missouri Budget Project. Her organization's analysis concluded the tax cut would leave out one-third of Missourians, and anyone making less than $22,000 a year would see an average annual cut of $3.

"Millionaires will get thousands of dollars from the bill," she said, "but those middle-income folks who actually do see a cut won't get much help in the face of today's rising costs."

In pitching his proposal, Parson has argued it puts money in taxpayers' pockets and while limiting politicians ability to fund pet projects through the budget.

"Every Missourian can support sending less of their money to the government," Parson said Wednesday, "and we trust Missourians to make decisions with their own money."

The rural incentives bill includes three tax credits to promote biofuels and other incentives for converting wood waste into energy, modernizing meat processing facilities and establishing urban farms.

"These wins will help further develop Missouri's agriculture industry, create opportunities for farmers, ranchers and ag-businesses," said Parson, who operates a cattle farm in Bolivar, "and help ensure Missouri agriculture remains not only our state's top economic driver but that its spirit and tradition continues to live on in the next generations."

The Missouri Independent, www.missouriindependent.com, is a nonprofit, nonpartisan news organization covering state government and its impact on Missourians.

Julie Smith/News Tribune photo: Flanked by district and farm representatives and Department of Agriculture Director Chris Chinn, standing to right of Gov. Mike Parson, Parson signed copies of the newly-passed farm legislation into law Wednesday, Oct. 5, 2022. Parson originally vetoed similar legislation as he wanted a longer time frame for farmers. The governor signed multiple copies to hand to interested parties.

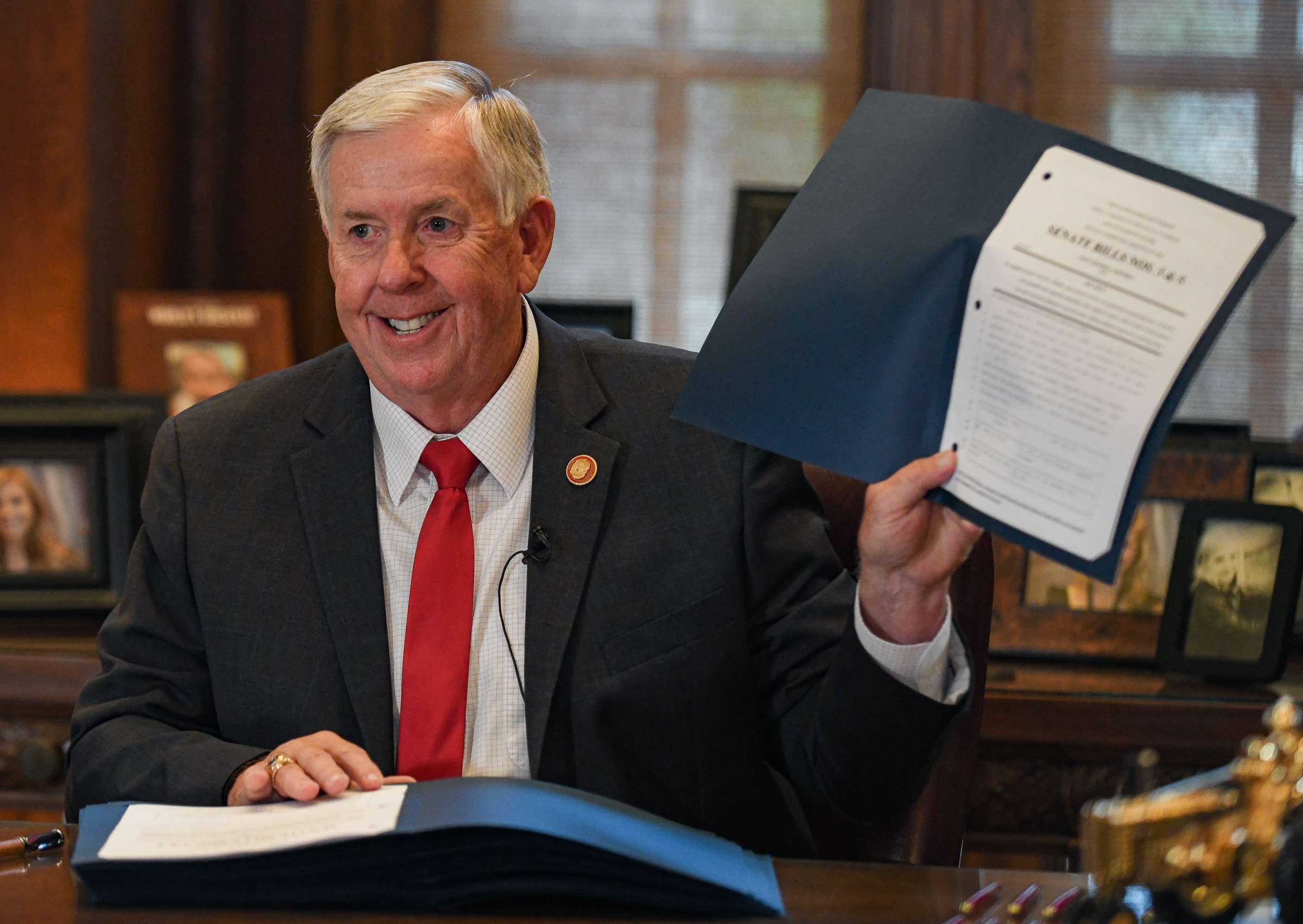

Julie Smith/News Tribune photo: Flanked by district and farm representatives and Department of Agriculture Director Chris Chinn, standing to right of Gov. Mike Parson, Parson signed copies of the newly-passed farm legislation into law Wednesday, Oct. 5, 2022. Parson originally vetoed similar legislation as he wanted a longer time frame for farmers. The governor signed multiple copies to hand to interested parties. Julie Smith/News Tribune photo: Before signing the just-passed tax cut into law Wednesday, Oct. 5, 2022, Gov. Mike Parson talked about the importance of the legislation and how he expects it to help Missourians be able to keep more of the money they've earned. Parson held a bill signing ceremony in his Capitol office where he also signed the new farm bill into law.

Julie Smith/News Tribune photo: Before signing the just-passed tax cut into law Wednesday, Oct. 5, 2022, Gov. Mike Parson talked about the importance of the legislation and how he expects it to help Missourians be able to keep more of the money they've earned. Parson held a bill signing ceremony in his Capitol office where he also signed the new farm bill into law.