Margaret Schaefer has enjoyed working in Jefferson City, first with the Employment Security Division at the state for a decade and for the past 25 years as a licensed practical nurse. At 65, she has put in her notice to retire this month.

It wasn’t an easy decision, but after difficult life events and working during the pandemic, she realized, “There’s a lot more important things than bringing home a paycheck.”

“I gave it my best for as long as I could, but it’s time for a new season,” Schaefer said. “When you come home tired, and physically and mentally exhausted, you know it’s time.”

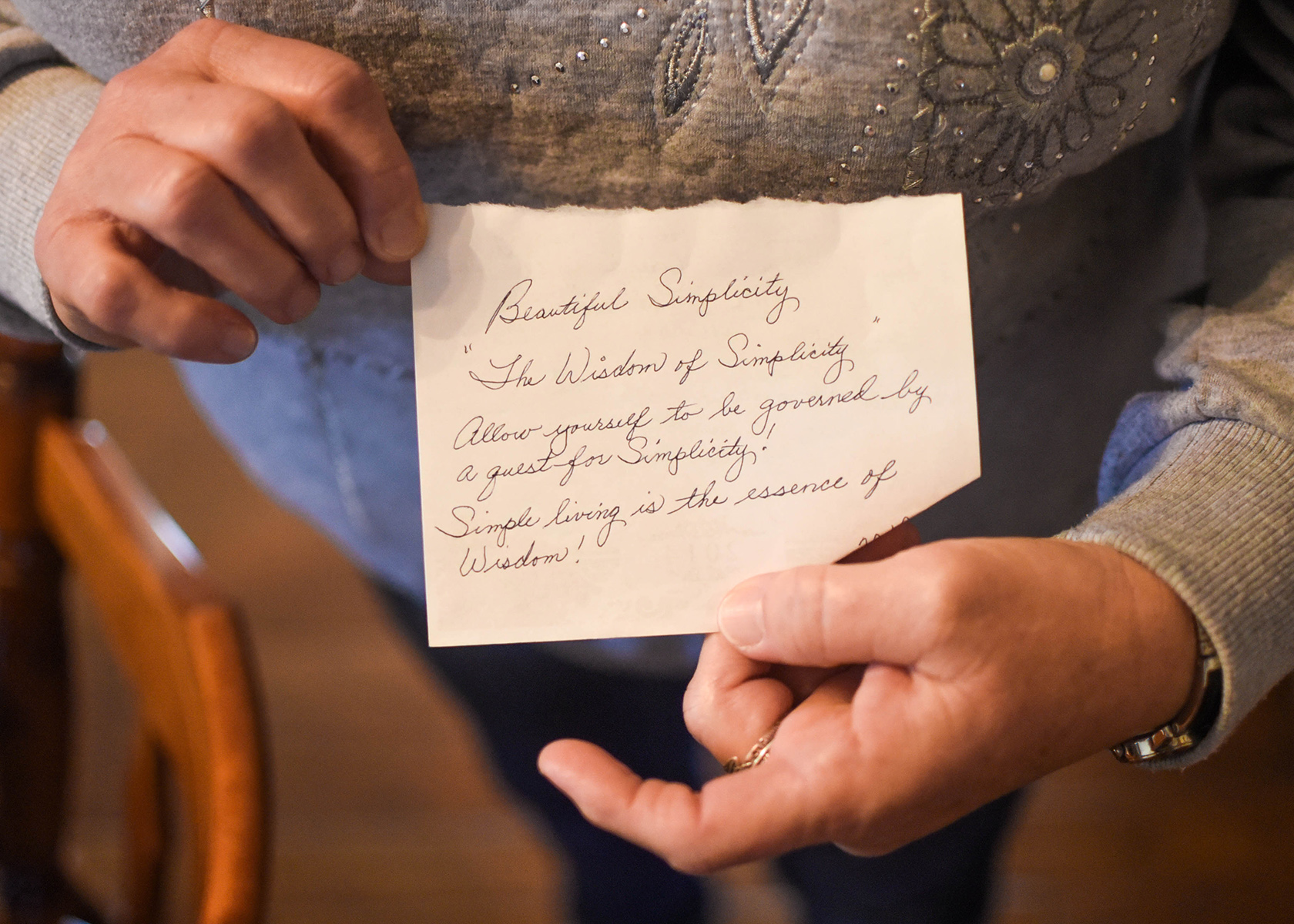

She has sought simplicity her whole life, quoting an advent devotion she had read that morning:

Allow yourself to be governed by a quest for simplicity. Simple living is the essence of wisdom.

“That kind of sums up how I’ve tried to live,” said Schaefer, who grew up on a farm learning the value of saving. “We’ve been very blessed in our family, but we led a simple life.”

Financially, she is ready for retirement. Schaefer’s son works for Central Bank and has helped plan her finances for the future. With the help of wealth managers early in her marriage, building up a Roth IRA — a retirement account where you pay taxes on money going into the account, then all future withdrawals are tax free — with Oppenheimer & Co. Inc. in St. Louis has helped a lot.

But, Schaefer admits, it’s scary going into a new chapter. She didn’t want to end up at 60 and realize she hasn’t planned her retirement.

Financial planners and experts agree: It’s never too early to plan. There are ways to plan successfully for retirement, and for those already in retirement, ways to find purpose in this new chapter.

Starting the retirement journey

Schaefer remembers breathing a sigh of relief after turning in her notice — “Now, I’m excited for a different chapter of my life.”

But questions followed: “Do I really want to do this?” “What do I do if inflation goes crazy?” “Could I work part time if I needed to?”

If you’ve been asking these questions, financial planners say they can help. Even if you need to meet with a planner and see your options, it can set you up for success down the retirement road.

Start looking for a financial planner within five years of retirement; this gives you time to find someone you trust, as they’ll be advising you for the next 20-30 years.

There are different types of planners depending on what you’d like to tackle:

• Financial planners/advisers can help with your retirement plan along with a comprehensive financial plan for your future. CFPs (certified financial planners) are not regulated like financial advisers, who must have a Series 65 license, but both are great options as you start to get your footing in retirement planning.

• Retirement planners go a step further than financial planning, as they are trained in handling Social Security questions, pensions, tax reductions and health care options specific to those retiring.

• Wealth managers can deal with clients with a high net worth, but as they focus on the holistic approach to your financial life. You don’t have to be wealthy to have a wealth manager. They can work with anything from college savings to estate strategies, thinking about finances and medical care now and after death.

With all the above, consider what their minimum asset requirement is, as most require you to have investable assets before starting.

It’s never too early to plan

After the death of a loved one, Schaefer began accounting for her assets and where they would go when she died — “death comes for us all,” she said.

She worked with a lawyer to do estate planning, designating who would receive her assets while minimizing taxes for beneficiaries. After that experience, she recommends others work with professionals sooner rather than later — making the road map for your life can help yourself and your children down the road.

Planners are important because people shouldn’t have to be their own advisers, said John Turner, of Providence Financial, which has Jefferson City and Columbia locations.

“People don’t have to be experts in retirement,” Turner said. “They’ve worked their entire lives and finally get to bear the fruit of that. They shouldn’t have to worry about where the money is coming from — that’s the job of an adviser.”

He recommends meeting with an advisor and gauging if they’re the right fit for you, then start to build that relationship. Be honest with them about your goals, such as when you want to retire, if you want to do a part-time job before fully retiring, where your 401ks and assets are floating around. Then, they will map out the clients’ life based on income sources, assumptions about where money is going and how to build on their financial plan — that’s why a personal relationship can be crucial.

Turner has found at Providence Financial, the first three years with the client is about doing the “heavy lifting” of gathering information and running numbers, then after that, advisers check in about their clients’ lives and adjust asset allocations as the market — and life — can change.

“After that third year, there’s a high level of trust and the conversations are more about life,” he said. “Things change, life changes and we’re holding their hand the rest of their life.”

Brian Zerr, of Finteris Wealth Management in Jefferson City, said the sooner you can meet with an adviser, the better. He has seen clients ranging from traditional retirement age to their 20s; for those nearing retirement, Zerr will recommend their children in their 30s start the process. Even if it’s a brief conversation, it can help clients think ahead.

“Even if you don’t know how much they want to save, I can give them rules of funding and saving five to 10 years before retirement,” Zerr said.

Even though you’re not investing as much in your younger years, Turner said, having that initial meeting with an adviser to talk about future plans can help establish goals for your current savings.

Finteris Wealth Management offers common retirement planning moves on their website, including talking with family about your financial portfolio and plans. Especially when planning with a partner or spouse, talking about your total assets, living off of another person’s income, budget, how much is in each account, etc. can ensure your plans are in alignment. Sitting down with a planner present, Zerr said, they can walk you through next steps based on what family members want.

Enjoying retirement

Schaefer will miss working with the babies in her unit. She’s also a people person and likes the socialization of a workplace. But she also has plenty to do in retirement: Schaefer loves her community in Frankenstein and wants to serve more, either through the local church or a food bank. And she could always volunteer at a hospital, working with children again even if it’s one day a week.

Staying home with her children when they were younger gave her purpose — now, she’s excited to have more time with her grandchildren.

“I did worry about boredom because I’m a people person, so I’d love to be involved in a group, share new ideas and interests,” she said. “Everybody I’ve talked to said, ‘You won’t be bored.’”

She’ll keep dancing at Capital Ritz, going to quilting groups and looking for her “niche” in retirement. Overall, she’s ready for the freedom that will come with this season because she feels prepared.

“There are no other clubs I belong to, but that might change,” she said. “Whatever comes along.”

———

What to do with your retirement?

Steve Buckles, president of Learning in Retirement at Lincoln University, said learning new things can be a good way to broaden your horizons during retirement.

“One thing we emphasize (in LIR) is having purpose after you retire and in life,” Buckles said. “This involves having a plan and asking, ‘What am I going to do with my life after I retire and don’t have to be at work 8 a.m.-5 p.m. every day?’ There’s an array of opportunities.”

LIR provides learning opportunities and experience for retired people and seniors in the Jefferson City area. They host travel opportunities, classes, clubs and other events that can help those who are retired to socialize while expanding their experiences, and at a cost — $3 per class — that doesn’t break the bank.

The keys to enjoying your retirement years are finding purpose and planning, Buckles said.

“The most successful retirements come from planning,” he said, “whether it’s financial planning or planning your time. One thing we emphasize is having a purpose after you retire and in life.”

This lines up with statistics. A 2019 report published in JAMA Network Open shows seniors who feel their life has purpose may be less likely to die from health issues and may live longer.

Buckles recommends getting involved in programs like LIR, SilverSneakers at the YMCA or religious groups — they can provide a sense of routine and socialization you might be missing from the workplace.

Each semester, members of LIR’s curriculum committee put together six to eight courses for members on topics like finances, history, religion, music, art and even retirement planning. The group also awards scholarships to LU students and ROTC members.

“I hear so many of our retirees say, ‘It is such a joy to get together with other people.’ The class provides that; trips and clubs provide that,” Buckles said. “LIR provides a good social outlet for those eager to expand and broaden their horizons.”

To learn more about Learning in Retirement, contact Steve Buckles at 573-690-2489 or [email protected]. Signup for LIR classes begins in January.