A Missouri task force whose job is to find innovations in the Missouri health insurance market will hopefully identify well-deserved options for the state's residents, said Chlora Lindley-Myers, director of Insurance, Financial Institutions and Professional Registration, and chairwoman of the group.

Lindley-Myers led the discussion as members of the Missouri Health Insurance Innovation Task Force convened for the first time Thursday morning.

"The governor has a keen interest in seeing that all Missourians - whether they live in large, urban areas or less-populated rural communities - have access to health options," she said. "We're here to engage in discussions about the ways in which we can address this issue and offer ideas that can be used to develop an 'innovative waiver' application."

Gov. Mike Parson signed an executive order July 17 to create the task force, which is asked to identify and develop concepts that "will result in significant innovation in the Missouri health insurance market." Those concepts are to be used in a (Section 1332) waiver application for the Affordable Care Act.

The waivers allow states to implement innovations, provided they are at least as comprehensive and affordable as coverage provided absent the waiver, according to the Centers for Medicare and Medicaid Services.

Kayla Hahn, Parson's policy director, reiterated the governor's wish to see the task force identify health innovations.

In addition to Lindley-Myers, the 12-member group includes lawmakers and representatives from insurance companies, hospitals and health commissions.

"There is significant interest in this topic," Hahn said. "Premiums have continued to increase. Individuals have not been able to continue to obtain the same level of coverage they previously had. This is something they take very personally."

Parson is very interested in expanding insurance markets into rural areas, she said.

That has proven challenging in the past, said Angela Nelson, director of the Division of Market Regulation.

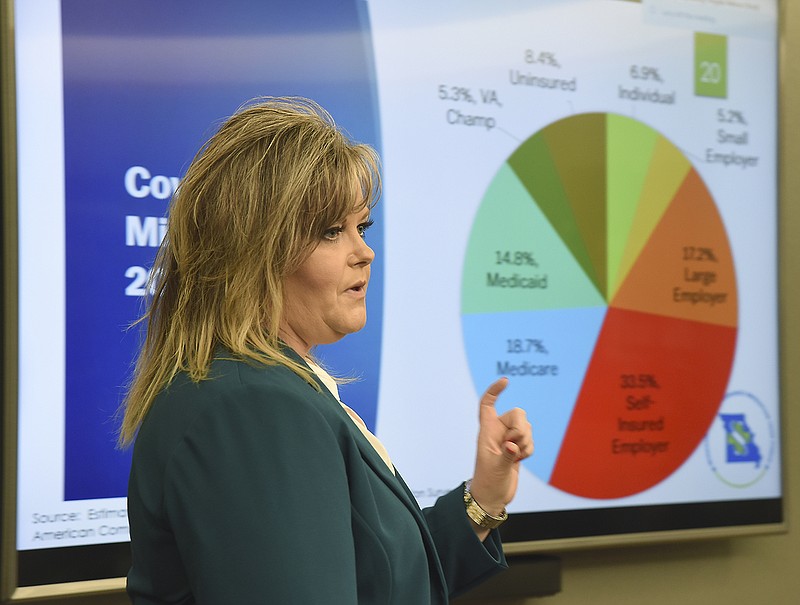

Reading from the executive order creating the group, which is to provide a final report to the governor no later than Jan. 31, 2020, Lindley-Myers said estimates indicated 8.4-9.1 percent of Missourians were uninsured, and more than 13 percent of residents in 73 counties were uninsured in 2017.

More than 15 percent of residents were uninsured in 43 counties.

And in 2019, only one insurance carrier was available in each of 101 counties.

"I'm going to take a little aside on that," she said. "It's not because I haven't begged, squealed and gone around the state to see if I could get more people to participate in the market. At least every county has one."

There are some counties that have more.

Recently released data, Nelson said, showed insurance providers have signed up to offer services in more counties in 2020, so the number of counties with only one provider will go down (to somewhere in the 80s).

And three counties in the Kansas City area will see much better competition, she said.

"In those three Kansas City counties, we're going to have four insurers competing," Nelson said. "Which is fantastic news."

Those competitors, she said, would be Medica, Cigna, Oscar and Centene.

In the St. Louis area there are three - SSM-Dean Health, Cigna and Centene - she said.

"We still have - by far and away - the vast majority of our counties will only have one insurer to choose from."

Lindley-Myers pointed out some of the most rural areas of the state continue to struggle to find insurers.

"In this area over here - in the Bootheel - we're still having problems getting carriers to go there," she said. "You'll find a carrier or two who'll say 'I'll go there, but there won't be anybody else competing with me.'"

Her department is trying to get somebody to compete with them, but the carriers say they can't make money there, she said.

The first few hours of the meeting were intended to give task force members an idea of what Lindley-Myers' department is dealing with daily, she said.

"It will sort of give you an overview of the marketplace - who's playing, who's not playing," she said. "And whether or not insurers could play a little more robustly."