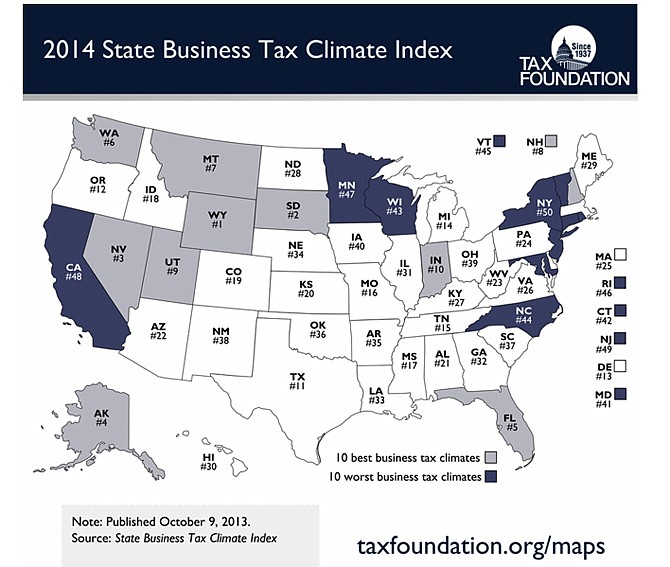

The tax climate of Missouri ranked 16th this year out of all 50 states, according to a new report by the Tax Foundation. The Show-Me State's rank remains unchanged from 2013 in the 2014 State Business Tax Climate Index.

Several states have moved in the rankings since last year, with Texas dropping out of the top 10 for the first time, landing at No. 11, and Virginia and Kentucky both falling three places to No. 26 and 27, respectively. On the positive side, Arizona climbed five ranks to No. 22 and Kansas shot up six spots to No. 20. Several other states also saw smaller changes.

"The states that lost ground this year usually did so because they changed policy in a way that makes the tax code more complex, burdensome or economically harmful," said Tax Foundation economist Scott Drenkard.

"By contrast, the states that improved did so because they are moving closer to a tax code that collects revenue without unnecessarily distorting business decisions. Their tax codes became more neutral."

The State Business Tax Climate Index, now in its 10th edition, collects data on more than a hundred tax provisions for each state and synthesizes them into a single, easy-to-use score. The states are then compared against each other, so that each state's ranking is relative to actual policies in place in other states around the country. A state's ranking can rise or fall significantly based not just on its own actions, but on the changes or reforms made by other states.

"The goal of the State Business Tax Climate Index is to start a conversation with policymakers about how their states fare against the rest of the country," said Drenkard. "With this report, we're asking: "How well is your tax code structured? Are businesses in your state spending too much time complying with onerous tax provisions? Are you double taxing things you shouldn't?'"

Access the report at: taxfoundation.org/article/2014-state-business-tax-climate-index.