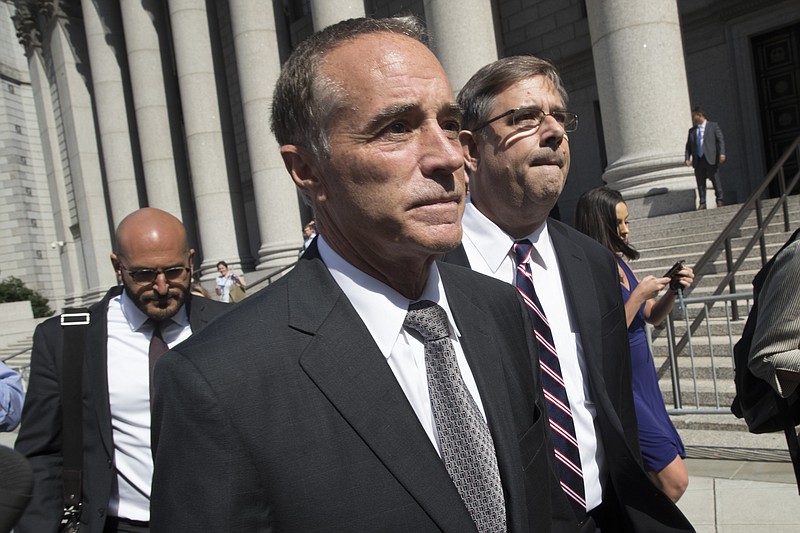

WASHINGTON (AP) - The indictment of Rep. Chris Collins on insider trading charges is drawing new attention to the freedom members of Congress have to serve on corporate boards or to buy and sell stock in industries they're responsible for overseeing.

Collins, a New York Republican, has denied any wrongdoing stemming from his involvement with Innate Immunotherapeutics Limited, a biotechnology company based in Sydney, Australia. He was Innate's largest shareholder, holding nearly 17 percent of its shares. He also was a member of the company's board of directors - an arrangement that itself isn't a violation of the law. Yet it's a connection that can create the potential for conflicts of interest.

Members of Congress are not prohibited from serving on corporate boards as long as they don't receive any compensation for doing so.

The thinking behind this exception, which doesn't extend to top-level executive branch officials, is to ensure that lawmakers aren't prevented from accepting positions on the boards of charities or other philanthropic organizations, according to Craig Holman of the nonpartisan advocacy group Public Citizen.

Holman, who lobbies in Washington for stricter government ethics and lobbying rules, noted that lawmakers are often privy to sensitive information before it becomes public. That makes the opportunity for insider trading "very prevalent," he said.

"My own office was stunned" by Collins' position, Holman said. "'Really, they can sit on a board of directors?'"

Government ethics lawyer Kathleen Clark said another downside of permitting members of Congress to be on corporate boards is that they may feel a sense of loyalty to the business, spurring them to share information with the company they obtained through government service.

Clark, a law professor at Washington University in St. Louis, also challenged the notion that service on non-commercial organizations is inherently altruistic and doesn't come with potential conflicts of interest. Even nonprofits can have an interest in seeing particular legislation passed, she said.

"In almost every situation, the ethics standards members of Congress impose on themselves are more lax than what they require of high-level executive branch officials," Clark said.

Stan Brand, senior counsel at the Washington law firm Akin Gump and former general counsel to the House, said the strength of the laws against insider trading should allay fears about corporate board service by lawmakers. It's irrelevant whether members serve on boards, he said. It's what they do with sensitive information that counts.

Brand said the potential distraction of being on a corporate board should be a bigger concern.

"Being a member of Congress is supposed to be a full-time job," he said.

It's difficult to know how many lawmakers have board positions. Each member of Congress files a financial disclosure report each year, but there's no central database where that information is available.

Collins was arrested Wednesday and charged with conspiracy, securities fraud, wire fraud and making false statements to the FBI. Parallel charges were filed against two other people, including Collins' son.

Prosecutors said Rep. Collins got an email from Innate's CEO while attending a picnic last year at the White House that said a trial of a drug the company developed to treat multiple sclerosis was a clinical failure. They said Collins told his son, who then dumped his stock in the company before the trial results were announced publicly. Several other people also benefited from the inside information.

A law known as the STOCK Act and signed into law by President Barack Obama in April 2012 prevents members of Congress "from trading stocks based on nonpublic information they gleaned on Capitol Hill," according to a White House fact sheet issued at the time. The law also required members of Congress report certain "investment transactions" within 45 days of making the trade.

However, according to a report Holman issued last year, the law's primary goal was to reduce insider trading by members of Congress, "not reduce stock trading per se."

Public Citizen compiled a database of stock trading activity by U.S. senators three years before the law's passage and three years after. It found "many individual senators continue to be very active in the stock market and often trade stocks in businesses that they oversee in their official capacity."