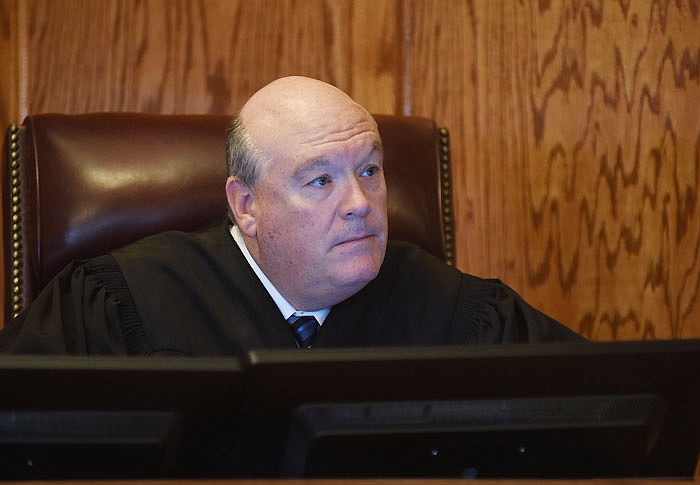

The fiscal note on the initiative petition proposal for a tobacco tax increase is "unfair," Cole County Circuit Judge Dan Green ruled Thursday. The ruling could prevent the petition from appearing on ballots this year.

He ordered state Auditor Nicole Galloway's office to prepare a new fiscal note or summary under the state law procedures controlling how initiative petitions are handled.

The petitions were circulated by the group Raise Your Hand 4 Kids, and submitted to Secretary of State Jason Kander's office on May 7 - one day before the constitutional deadline - with more than 320,000 signatures of registered Missouri voters from throughout the state.

Supporters propose raising tobacco taxes over the next few years so the state can fund Missouri early childhood health and education services and smoking cessation programs for pregnant mothers and youth.

Local election officials in each county where petitions were gathered must verify the signatures are of properly registered voters before the proposal can be placed on the Nov. 8 general election ballot.

But state law also requires that, as they are being circulated, petitions show the secretary of state's ballot language and the state auditor's fiscal note summary so voters know what they're endorsing.

Green's ruling could prevent the proposal from being voted on this year.

"Because the case may be appealed to a higher court, our office will continue to process the petition pending the completion of the legal process," Stephanie Fleming, Kander's spokeswoman, said Thursday evening.

Jefferson City attorneys Khristine Heisinger and Chuck Hatfield filed the lawsuit Jan. 15 on behalf of Jim Boeving, Springfield, who owns the business Discount Smokes & Beer.

The lawsuit said both the secretary's ballot summary and the auditor's fiscal note were "insufficient and unfair" - standards set by the state law on initiative petitions - and some parts of the proposal violate Missouri's Constitution.

The law requires initiative petition supporters to submit their proposed issue to the secretary of state, including the statutory or constitutional language they want to add or change.

The secretary then shares the proposal with the attorney general's office, which must agree the petition meets the law's required form.

The proposal then goes to the auditor's office to study possible effects on state and local governments, prepare a fiscal note on the proposal's financial impact, and a summary to appear on the petitions and the election ballot.

The secretary of state's office prepares a ballot title that also goes on the petitions and election ballot.

Kander's title for the tobacco proposal reads:

"Shall the Missouri Constitution be amended to:

increase taxes on cigarettes each year through 2020, at which point this additional tax will total 60 cents per pack of 20;

create a fee paid by cigarette wholesalers of 67 cents per pack of 20 on certain cigarettes; and

deposit funds generated by these taxes and fees into a newly established Early Childhood Health and Education Trust Fund?"

The auditor's fiscal note says: "When cigarette tax increases are fully implemented, estimated additional revenue to state government is $263 million to $374 million annually, with limited estimated implementation costs. The revenue will fund only programs and services allowed by the proposal. The fiscal impact to local governmental entities is unknown."

Boeving's lawsuit raised several questions, including a challenge that the ballot language fails to inform voters how money raised by the increased tax would be used.

Green agreed but found: "Even though the summary statement gives no notice of the uses of the funds or of change to our constitution in the measure, it is not insufficient and unfair" as defined by the state law.

Fleming said: "We're pleased the court found our ballot summary language fair and sufficient."

However, Green also found in a 10-page judgment, the fiscal note summary failed in two ways: "It includes a revenue projection that was calculated with zero price elasticity of demand (for cigarettes and other tobacco products), and it states the fiscal impact to local government is unknown," when there were some estimates of revenue losses to local governments.

He vacated the fiscal note summary - meaning it legally doesn't exist - and sent it back to the auditor's office for more work.

Green said it was too soon to decide Boeving's arguments that part of the proposed amendment are unconstitutional.