Some of Jefferson City's largest companies aren't paying thousands of dollars in taxes. And local officials are okay with it.

Actually, it was their idea.

The local business community welcomed manufacturer Continental Commercial Products (CCP) and its promise of 200 new jobs when the company announced in April it would move its Bridgeton facility here. Convincing parent company Katy Industries to select Jefferson City over three other Midwest locations required a generous incentive package that included a $500,000 infrastructure grant paid by the city and county, as well as a 100-percent real and property tax abatement for 10 years - meaning the new manufacturer will owe no property tax to the city or county on its high-dollar equipment until 2026.

This is not the first time a company's property tax has been abated - three other Jefferson City companies, plus a fourth whose tax abatement ended last year, are not paying taxes on some or all of their property and real estate.

Tax tools

The Missouri Department of Economic Development authorizes about 20 types of tax incentives that range from those encouraging local expansions to those attracting out-of-state businesses to relocate to Missouri. The Jefferson City Area Chamber of Commerce, which contracts with Jefferson City and Cole County for economic development work, primarily uses two of them.

"Almost every company now wants a tax abatement," said Missy Bonnot, director of economic development for the chamber. "If we want them in our community, then we have to offer incentives."

Chapter 100 industrial revenue bonds allow local municipalities to write off a manufacturing company's personal property and/or real estate taxes for a certain period of time as a way to encourage economic development in the area. (Chapter 100 refers to the section of the Missouri Revised Statutes that authorizes the bonds used to finance real estate improvements or machinery purchases.)

The municipality technically takes ownership of the tax-abated real estate and equipment until the period of abatement ends - effectively making the property tax-exempt on the basis of public ownership.

"It's really just a paper transfer," said Randy Allen, president and CEO of the chamber.

Jefferson City's incentive package was a major factor in attracting CCP: "There's always incentive packages when you look at moving a location. Between the opportunities with the building and then the overall package of incentives together, I think those two things as a combination made it a better deal," said Brian Nichols, the company's vice president for risk management, human resources and legal affairs, after the relocation was announced.

Two case studies: Command Web and Modern Litho

Three Jefferson City companies - ALPLA, Modern Litho and Unilever - have active industrial revenue bonds with property tax abatements. A fourth, Command Web, will begin generating new tax revenue this year after an abatement that spanned 2010-14.

Together Command Web, Modern Litho and ALPLA were exempted from more than $300,000 in real and personal property tax in 2014 alone. (The actual total is higher, as this does not include Unilever's two personal property tax abatements, for which a value could not be calculated due to insufficient records of equipment values filed with the Cole County Assessor's Office.)

Command Web saved more than $1.3 million over its five-year, 100-percent abatement on new real and personal property tax associated with its 2010 building addition and new equipment - a $20 million investment.

The company, which manufactures soft-cover books and began operations in Jefferson City in 1994, added a 43,000-square-foot building to its existing facility, along with a new press that allowed for printing juvenile books in two popular sizes, a new binding line that accommodated those sizes, and other support equipment.

Command Web considered locating the expansion in other communities, including Robbinsville, N.J., where it already had a plant.

"That plant had available space to put all this equipment in. And so we, in a sense, were competing against our own organization," said Chris Huckleberry, Command Web - Missouri general manager.

It also promised to add 50 new local jobs to its existing 150.

"We wouldn't have needed the jobs without the new equipment," Huckleberry said.

As it turned out, the building expansion cost the company about $1.2 million up front, which the property tax savings over five years offset.

"It just helped push things in the direction of where it wasn't a discussion anymore," Huckleberry said.

When the Cole County Collector's Office bills Command Web for 2015, the company will begin paying about $350,000 in combined real and personal property tax (depending on the 2015 tax levy, which will be set in September). At that rate, it will take four years for Command Web's property taxes paid to equal the amount abated over five years.

DO THE MATH ...

Command Web's existing building before the 2010 expansion had a taxable assessed value of $1,860,290. The company continued paying roughly $102,500 per year from 2010-14 in real estate tax on this building. (Exact tax values fluctuated slightly each year as tax levies changed.)

The 2010 expansion upped the building's assessed value to $2,585,180. The company was not billed for real estate taxes on the new $724,890 in assessed value from 2010-14 - equating to just under $40,000 per year in abated real estate tax, or almost $200,000 over those five years.

Command Web also continued paying between $57,000 and $69,500 in personal property tax on the equipment it owned before 2010 for those five years. (Market values and consequent taxes varied each year due to equipment depreciation.)

But the new equipment added as part of the 2010 expansion brought Command Web's personal property to a taxable assessed value of about $1.4 million, which would have brought an additional personal property tax bill of between $179,000 and $245,000 each year from 2010-14 - roughly $1.1 million over those five years.

All together, the incentive saved Command Web more than $1.3 million in real and personal property taxes.

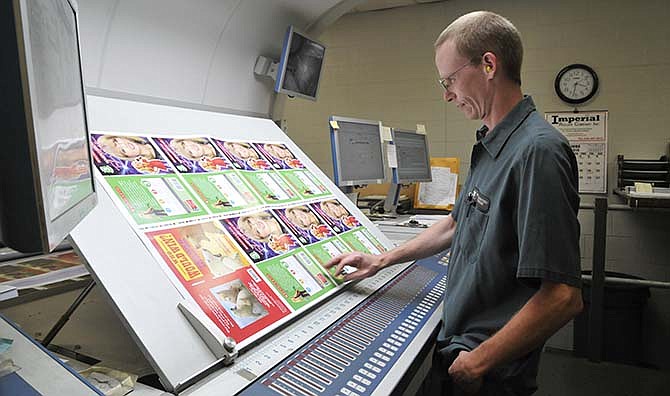

Modern Litho, another commercial printing company with operations in Jefferson City, has already saved nearly $100,000 just two years into its five-year, 100-percent personal property tax abatement for its new, $3.75 million printing press purchased in 2012.

The project was estimated to create between five and 20 new jobs, but has already created 30, said Modern Litho President/CEO Darrell Moore.

Without the tax incentive, "I don't think we would have done it at that time," Moore said. "It's our biggest investment we've ever made as a company."

DO THE MATH ...

The new printing press raised the assessed value of the company's personal property to about $1.8 million, which would have made the personal property tax bill about $89,000 in 2013 and about $73,000 in 2014. Still paying about $30,000 to $35,000 those years on existing equipment, Modern Litho saved about $97,000 in abated taxes over the first two years of the abatement period.

The Cole County Assessor's Office estimates Modern Litho's tax abatement will value about $61,000 for 2015 (based on the 2014 tax levy), and it will continue for two more years after that.

At what cost?

Three local government entities primarily benefit from property tax revenue: Jefferson City, Cole County and the local school district, which in each of these cases is Jefferson City Public Schools (JCPS).

The school district has the most to lose from abating potential tax revenue, as it receives the most benefit from property tax collected, and local property tax accounts for roughly half of the district's annual revenue.

Because the city and county have other sources of revenue, like sales tax and the city's manufacturing utility tax, "they can make up for their losses in property tax, but we don't really have that option," said Jason Hoffman, JCPS chief financial officer.

Although the city technically gives the nod to offer tax abatements for projects in city limits, the Chamber of Commerce's policy is to get approval from each entity via the Incentives Task Force. The task force includes the Chamber Executive Committee, all three Cole County commissioners, two City Council liaisons (currently Bob Scrivner and Rick Prather), the Jefferson City mayor and city administrator, and the JCPS superintendent and CFO.

"We're really thankful at the school district that we get a seat at the table and get our voices heard," Hoffman said, noting many of his colleagues around the state are not consulted by their municipalities about tax abatements affecting their school districts. "There's been some push and pull and compromise to come up with proposals, but we've always come to an agreement."

The roughly $300,000 of abated property tax in 2014 between Command Web, Modern Litho and ALPLA (again, not including Unilever's two tax-abated projects) would have increased JCPS' property tax revenue by about $220,000, or 0.5 percent of its total property tax revenue last year.

A consideration for the school district is providing services to additional students as their families move to the area for jobs provided by new or expanding companies, especially when JCPS already is dealing with overcrowding issues.

"We look at the overall economic impact on the community and then try and see how many additional students that is going to be for us," Hoffman said. "Additional students are an additional cost for us, and an additional space concern."

That added cost per student can be difficult to estimate, as it depends on factors like which grade levels new students fall in and whether new teachers would need to be hired. It was less of a concern when deciding to incentivize the CCP project.

"We just lost the same number of jobs from that same building," Hoffman said, referring to the RR Donnelley plant's 2013 closing that initially left 475 people unemployed. "We didn't really see a decrease in our student enrollment because of that, so hopefully there are workers in our community who can take these jobs."

Cole County and Jefferson City would have seen an additional $52,000 and $27,000 in 2014, respectively, which would also have increased total property tax revenue for both by 0.5 percent.

Return on investment

Attracting new business offers more economic advantages than commercial property tax revenue. It also brings jobs - and, more importantly, wages.

"It's really the wages that drive our economy and the growth of our economy," Allen said.

CCP promised to create 200 local jobs by the end of 2016. With the company paying an average annual salary of $33,000, the chamber estimates those jobs will create $6.6 million in new wages - an increase of roughly 0.33 percent to Cole County wages overall.

What will future CCP employees do with those wages? Spend.

"Wages equal other kinds of return to the city and county," like increased sales tax receipts and new dollars making their rounds in the local economy, Allen said. "Those people that are taking jobs in there are still paying their taxes."

The chamber expects new wages from CCP to produce about $169,740 a year in new property and sales tax revenue for Cole County and Jefferson City together, plus almost $164,000 a year in new property tax revenue for JCPS.

All together, that would amount to 2.57 percent of all new wages from CCP making their way into city and county revenues.

"The company is not paying (property tax), but all these families are paying through buying houses and buying boats and all those sorts of things," Allen said. "It's better for everybody that these are incentivized in the short term for the long-term growth of that appraised value and that tax base."

DO THE MATH ...

The Chamber of Commerce estimated that $6.6 million in new wages would generate about $46,500 in additional residential property tax revenue annually - $15,768 for Jefferson City and $30,731 for Cole County. That's based on an expected $2.8 million in new assessed value for Jefferson City and $4.5 million in new assessed value for Cole County, assuming each entity's assessed value rises proportionally with the rise in wages.

The new $4.5 million in Cole County assessed value would produce $164,000 a year in property tax revenue for JCPS based on the 2013 school tax levy of $3.6928 per $100 of assessed valuation.

Also expecting sales tax revenues to increase proportionally with the wage increase, by 0.33 percent, the chamber factored in an estimated $123,240 in new annual sales tax revenue to the city and county.

It's difficult to estimate how much potential tax revenue the city, county and school district are forgoing by abating CCP's real and personal property taxes for 10 years, as the company's equipment has not yet been assessed in Cole County and the building's appraised value will change once the company moves in and puts the building to use.

A conservative estimate might expect about $117,200 a year in abated potential property tax revenue to the city and county - $1.17 million over the 10 years of the abatement.

That's $52,540 less than the estimated $169,740 in new sales and property tax value the chamber expects the new wages to generate - $525,400 over the 10 years of the abatement. So, if the chamber's projections are correct, local stakeholders would still come out slightly ahead year by year even before CCP begins paying local property taxes.

DO THE MATH ...

CCP's future Jefferson City facility, at 321 Wilson Drive, has an assessed value of $1.12 million for 2015, based on its current use as warehousing space. That assessed value will increase to some degree when reassessed for CCP's purposes, said Cole County Assessor Chris Estes. At that value, though, it would generate $61,812.80 per year in real property tax at the 2014 tax rate.

The 2014 assessed value of CCP's personal property in Bridgeton was $1,003,680, which would generate $55,393.10 in annual personal property tax at Cole County's 2014 tax rate.

Together, that amounts to about $117,200 a year in abated property tax - $78,423.26 that would have gone to JCPS, $26,972.86 to Cole County and $11,809.78 to Jefferson City.

There might not be a definite answer to whether unpaid taxes pay off when used to encourage development.

Research on the topic is limited, as the details of each state's available incentives vary. One 2013 Ball State University study concluded that Indiana's local tax abatements were correlated with higher property tax rates, and that the margin by which tax abatements helped increase the property tax base was relatively small - making the tools less effective in the short term. The study did not draw conclusions on the long-term effectiveness of local tax abatements, but did recommend a comprehensive review of the state's economic development incentives.

Most people making the decisions to offer local tax incentives see it as a necessity with limited options.

"I think we're almost to the point where we have to do that if we want to have people move to our communities, just because so many other communities are desperate to get somebody to move to their community," Hoffman said.

Scrivner added: "Obviously there are times when it works very, very well, and maybe times when it hasn't worked quite as well; but it's the tools that we have based on state law. The Legislature has set up those rules, and if we want to provide incentives of some kind or another, that's the incentive choices that we have."

Regardless of how effective tax abatements are in creating short-term growth, they are attractive to companies.

"It's an incentive to stay put, expand your operation here; and that's exactly what we did," Huckleberry said of Command Web. "We did bring in people from outside Cole County, outside the state of Missouri, who would not have been coming had it not been for the new equipment and the expansion."

"You're trying to grow the overall economy of a community," Scrivner continued. "If a business in one part of the community grows and creates more jobs and so forth, you have an expanding economy, which is good for everyone. Even if it may not be the perfect way of doing it, it is a positive way of doing it."

Check out the latest business features inside #jcmo Inside Business at http://www.newstribune.com/special-sections/jcmo/