Jefferson City sales taxes surged ahead of projections and the city now is forecasting a surplus of more than $500,000 for the end of the fiscal year.

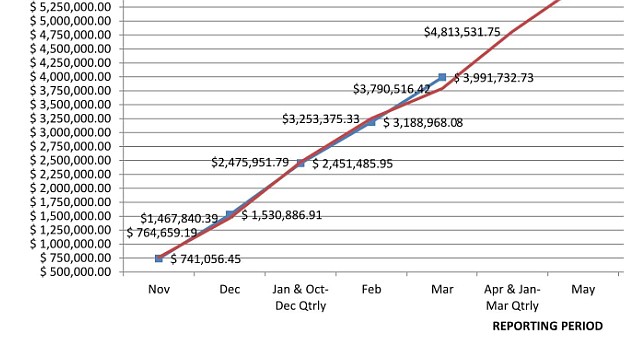

At the Finance Committee meeting Wednesday, interim Finance Director Bill Betts reported that May receipts, which reflect the March reporting period for sales taxes, far exceeded projections in all three tax categories, with the 1 percent general revenue sales tax coming in more than $265,000 above projections.

Betts said staff was stunned by the numbers and is requesting additional reports from the state to try to get a better understanding of why receipts jumped so high in one month.

The surplus in tax receipts put the 1 percent general revenue sales tax at more than $200,000 above projections for the year to date.

The city's half-cent capital improvement tax came in more than $133,000 above projections for the month, putting it $47,000 above projections year to date.

The half-cent parks tax came in more than $131,000 above projections for the month, putting it $86,000 above projections year to date.

"It's a great month, and we'll see where we go from here," Betts said.

With the added sales tax funds, the city's revenue forecast model is projecting the city will end the 2014 fiscal year with more than $540,000 in surplus funds. While roughly $200,000 is attributed to the increase in sales tax revenues, more than $300,000 is from surplus franchise and utility taxes.

All of the financial documents from this month's Finance Committee meeting are available at www.jeffcitymo.org/finance/FinancialReports.html.